We help new Australian migrants

Get A Home Loan!

Most VISA Types Accepted (not 500)

Get A Home Loan!

Most VISA Types Accepted (not 500)

Are you New to Australia and want to know if home ownership is possible while on a temporary visa?

YES, IT IS!

We're here to guide you through every step of this exciting journey.

Understanding The Costs:

As a temporary resident, there are additional costs to consider:

Government Fees:

Foreign Investment Review Board (FIRB) application fee: $42,300 for properties under $1 million.

Stamp Duty:

Additional Foreign Purchaser

Stamp Duty is 11 or 12% of the property value (varies by state).

But don't let these costs discourage you! With proper planning and our expert guidance, your Australian property investment can still be highly rewarding.

How We Help You..

✅ Navigate FIRB approvals with confidence

✅ Find lenders who specialize in temporary resident mortgages

✅ Discover property hotspots with strong growth potential

✅ Understand tax implications and maximize deductions

✅ Complete paperwork correctly the first time

Take The First Step Today..

Leave your details below for a call back.

Our migration property specialists will contact you within 24 hours to discuss your unique situation.

ABOUT US

We started Temporary Resident Finance to help new Australian Migrants obtain vehicle and home finance.

Most banks and lending institutions will not offer finance to temporary VISA's such as 485, 489 and 491.

We help guide you on the finance options available for new Australian migrants on Temporary Visas. Non-citizens deserve a home to call their own too.

unsure if you can buy?

You need 3+ years left on your Visa.

*We CANNOT offer finance to 500 Visa..

Contact Us

Contact Us

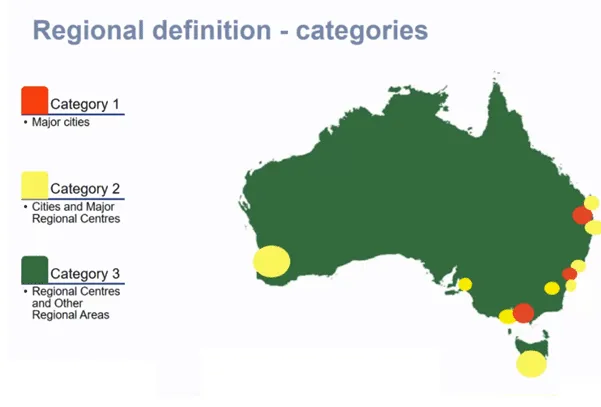

491 visa

Home loans for 491 Visa holders. This visa is for skilled people, nominated by a state or territory government, to live and work in regional Australia

485 visa

Car loans for 485 Visa holders. This visa allows international students to live, study and work after you have finished your studies.

489 visa

Car Loans for 489 Visa holders. This visa is for skilled workers who want to live and work in regional Australia

get home finance, today!

Australian Credit Representation Number of Credit Licence Number 392169 ACN 084 974 694.